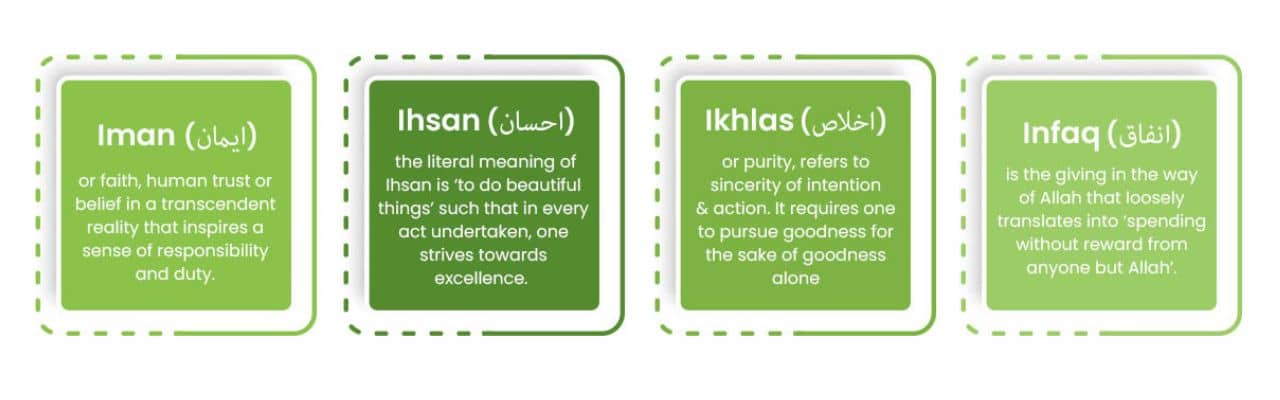

Akhuwat is a not-for-profit organization which was founded in 2001 on the Islamic principle of Mawakhat مواخات or solidarity. The concept of Mawakhat predates to 622 CE when Prophet Muhammad (Peace Be Upon Him) urged the residents of Medina (Ansars) to share half of their belongings with the Muhajirs (migrants) who were forced to flee persecution and migrated from Mecca to Medina. Drawing inspiration from the generosity displayed by the Ansars, Akhuwat believes that if the same approach, where one affluent family embraces a less fortunate one is adopted today, inequality will be eradicated from the world. read more

Want to start a business, support your family, or fund your dreams without going into debt? The Akhuwat Foundation Loan provides interest-free financial help to people in Pakistan. This way, you can grow without the stress of paying interest.

Our loans follow Islamic principles of Qarz-e-Hasna. They help you create a better future with dignity and independence.

Join millions who are already benefiting from Pakistan’s most trusted loan program.

Ready to apply? Contact Us or Message Us on WhatsApp

Akhuwat Foundation offers a zero markup loan. It is a non-profit group that aims to end poverty by empowering people. Instead of charging high interest rates, Akhuwat gives interest-free loans. These loans help individuals and families improve their lives, following the Islamic principle of Qarz-e-Hasna, or benevolent loan.

Akhuwat was founded in 2001 with a clear goal: to create a society without poverty by helping low-income families with compassionate finance. Unlike banks, Akhuwat does not charge any interest on loans. Every loan is designed to help, not to create debt.

The foundation works with local partners and relies on community support and donations to make sure the people who need help the most receive it at the right time.

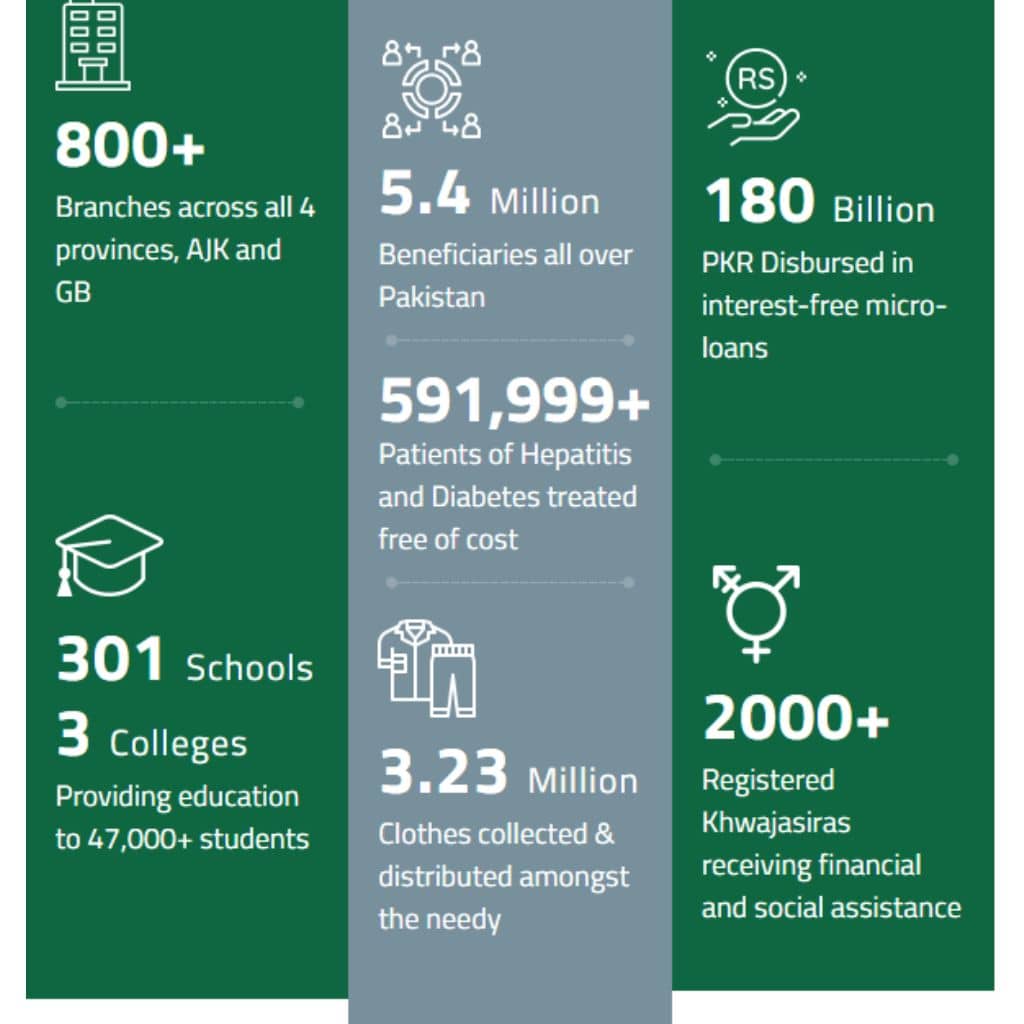

Akhuwat is the world’s largest interest-free microfinance organization, with over 5.5 million loans given out across the country. From small villages in Sindh to busy markets in Lahore, Akhuwat is changing lives through lending that respects people’s dignity.

By trusting communities and removing interest, Akhuwat creates a circle of trust and support. When one loan is paid back, it helps another family in need.

Are you interested in a zero markup loan? Contact our support team or chat with us on WhatsApp. We’re here to help you take the next step.

Anyone in Pakistan with a real need and a plan can get an interest-free loan from Akhuwat Foundation. The foundation focuses on trust, dignity, and inclusion, providing equal financial support to everyone.

Akhuwat helps young students pay for education, housewives starting home businesses, and people with disabilities seeking independence.

To apply for an interest-free loan, you need to:

If you fit any of these criteria and want to move forward, contact us today or message our team on WhatsApp. A brighter future begins with a simple chat.

Many people ask if they can get an Akhuwat loan without collateral. The answer is yes. Akhuwat Foundation offers interest-free loans without requiring any collateral. You don’t need to own land, property, or gold to receive help.

Akhuwat’s approach focuses on trust instead of wealth. We aim to empower people through compassion, not by asking for security. Every loan is given with dignity, relying on community support rather than traditional assets.

Here’s how the zero-collateral model works:

This model helps poor people, including workers, small vendors, and students, get fair, interest-free financial support.

By eliminating the need for collateral, Akhuwat has helped millions escape poverty and improve their lives.

Not sure how this can help you? Contact us or send a WhatsApp message, and we’ll find the best option for you.

Akhuwat Foundation changed microfinance in Pakistan by giving interest-free loans to people in need. They believe in using financial help to empower, not burden, people. The loans help individuals and families with money problems to start businesses and become financially stable. To get a loan from Akhuwat, start by filling out an application at any of their branches. Akhuwat staff will review your finances, needs, and growth potential to make sure the loan goes to those who will benefit and use the money well for economic development.

Akhuwat Foundation provides different loans to meet specific needs like business, education, marriage, and emergencies. Business loans help entrepreneurs start or grow small businesses. Educational loans support students from low-income families in pursuing higher education. Marriage loans assist with wedding costs. Emergency loans provide fast financial help during crises like natural disasters or medical emergencies.

Akhuwat’s loan program involves the community. Borrowers are encouraged to repay loans in small amounts, promoting responsibility. The program also encourages borrowers to become donors in the future, giving back to the community. Akhuwat’s loan program in Pakistan has helped many people escape poverty, become financially independent, and improve their lives. The program gives interest-free loans and promotes mutual support, making a big impact on Pakistan’s development.

Applying for an Akhuwat loan is simple and accessible, showing the foundation’s dedication to helping people in need. The process includes steps to make sure loans go to deserving candidates who will benefit the most. Here’s a detailed guide on how to apply for an Akhuwat loan:

Step 1: Initial Inquiry

To start, go to the nearest Akhuwat branch. They have many branches all over Pakistan, so it’s easy for people from different areas to use their services. At the branch, ask about the types of loans and get the details for applying.

Step 2: Eligibility Check

Before filling out the application form, it’s important to ensure that you meet the eligibility criteria. Akhuwat Foundation typically requires that applicants:

Step 3: Documentation

Prepare the necessary documents to support your application. These documents generally include:

Step 4: Application Form

Fill out the Akhuwat loan application form accurately, providing all required information. This form can be obtained from the branch or downloaded from our website. Ensure that you detail your financial needs and plans for utilizing the loan effectively.

Step 5: Submission and Initial Review

Submit the application form and required documents at the Akhuwat branch. The staff will review it to make sure you have provided all the needed information and documents.

Step 6: Field Verification

Akhuwat’s field officers will visit your home or business to check if you qualify for a loan. This helps Akhuwat know more about your situation and decide if you can get the loan.

Step 7: Loan Approval

After verifying your application, a loan committee will review it. If approved, you will be informed about the loan amount, terms, and conditions. Akhuwat values transparency and will clarify all parts of the loan agreement for you.

Step 8: Distribution

After you agree to the terms, we will give you the loan quickly. Akhuwat makes sure the process is fast and efficient so you can get the money without delays.

Step 9: Utilization and Monitoring

After getting the loan, it’s important to use the money for its intended purpose. Akhuwat Foundation may check how the loan is used and offer help if needed. This helps make sure the loan is used for things like starting a business, paying for education, or handling emergencies.

Step 10: Repayment

Borrowers can repay in small, easy installments without financial stress. Akhuwat’s interest-free model lets you repay only the principal amount, building trust and community support.

Akhuwat Foundation disburses loan payments based on your application stage and loan category. They aim for a clear, respectful, and timely process for all applicants. After reviewing and verifying your application, funds are released within 2 to 4 weeks through a community-based approach that ensures transparency.

Step-by-Step Disbursement Process

Key Highlights

This public disbursement model promotes responsibility and builds trust between Akhuwat, the borrower, and the community. Every transaction is tracked, and every borrower is treated with respect.

If you’re still waiting for your loan or have questions about the timeline, contact us here or message us on WhatsApp. We’re here to help you!

If you’re curious about the repayment terms for an Akhuwat Foundation loan, here’s the simple answer: you repay what you borrow, without any interest, in a way that fits your income. At Akhuwat, we believe financial support shouldn’t be a burden. Our repayment model is based on trust, flexibility, and fairness.

Every rupee you repay helps another family in need. It’s a cycle of kindness, not profit.

Borrowers are encouraged to stay accountable through local support networks. Many loans are given to groups, where members encourage each other to keep up with payments. This approach builds a sense of responsibility and strengthens community trust.

By repaying your Akhuwat loan, you not only become self-reliant but also help fund the next borrower’s journey. It’s not just a loan; it’s a chain of empowerment.

Need help with your repayment plan or adjusting your schedule? Contact our support team or chat with us on WhatsApp — we’re here to help you succeed.

Akhuwat Foundation provides different types of loans to help people and communities in Pakistan. These loans are made to solve financial problems and help borrowers improve their lives. Here is a detailed overview of the different loan types provided by the Akhuwat Foundation:

Akhuwat’s microfinance program relies on business loans to support entrepreneurs in starting or growing small businesses. This helps create jobs and improve local economies. Key features of Akhuwat business loans include:

Akhuwat helps students from low-income families pursue their academic goals by offering educational loans. The loans cover tuition fees, books, and other educational expenses. The main features include:

Marriage loans help families pay for wedding expenses. Akhuwat offers these loans to support families with the costs of weddings. Akhuwat offers:

Emergency loans help quickly when there’s a crisis like natural disasters, medical emergencies, or unexpected personal problems. Key aspects include:

Akhuwat provides housing loans to help people and families improve their homes. The loans can be used to build new houses or fix up existing ones. Important features include:

Health loans are made for medical expenses like treatments, surgeries, and medications. They help people get necessary healthcare services without money problems. Features include:

Many people ask if Akhuwat loans can cover wedding costs. Yes, but there are guidelines. Akhuwat understands that weddings are important in Pakistan and that families often feel financial stress during this time. To help, Akhuwat provides interest-free loans for essential wedding expenses that follow the values of simplicity and responsibility.

You can use an Akhuwat loan for:

Akhuwat does not support lavish weddings or luxury spending. The loan should only cover real needs, not social status or competition. Fancy decorations, large events, or expensive items are not allowed.

Eligible applicants include:

Akhuwat aims to help families have respectful weddings without incurring debt. Each loan is approved after community checks to ensure responsible use.

If you need financial support for a simple wedding, contact us or WhatsApp us for guidance on how to apply easily and respectfully.

If you want to repay your Akhuwat loan through a bank, you’re in luck! Akhuwat provides several easy repayment options for borrowers in Pakistan. You can pay through bank transfers, digital wallets, or by visiting a branch.

No matter if you live in a city or a village, you can pick the method that fits your schedule best.

Every payment helps another borrower in need. So, it’s important to pay on time, not just for yourself, but for others too.

If you need help finding your bank details or changing your repayment method, reach out to our support team or WhatsApp us. We’re here to help you!

Akhuwat’s interest-free loans have changed the lives of millions of families in Pakistan, providing hope and dignity instead of debt.

Akhuwat’s loan model focuses on more than just money. It encourages self-reliance, builds community trust, and promotes lasting change by eliminating interest (riba) and fostering compassion, accountability, and shared success.

Akhuwat has provided over 5.5 million loans in Pakistan, with a repayment rate of 99.9%. This shows that trust builds stronger communities.

Want to create a better future for your family? Apply now or chat with us on WhatsApp – your journey to dignity starts today.

Here are answers to common questions about Akhuwat Foundation’s interest-free loans. This information helps applicants throughout Pakistan.

You can call Akhuwat Foundation at their helpline. For faster help, visit the Contact Us page or message us on WhatsApp.

Yes, unemployed people can apply if they have a good business idea or plan to earn money. Akhuwat helps with startup loans for self-employment.

Akhuwat loans range from PKR 10,000 to PKR 100,000, based on the loan type, your ability to repay, and location. Special schemes may offer higher amounts.

Yes, Akhuwat gives agriculture loans to small farmers and rural families for buying seeds, fertilizers, and basic equipment.

There is no specific deadline. You can apply at any time. However, some programs may prioritize applications, like the 2025 Housing Programme.

They verify applicants through community visits, interviews, and support from local references or guarantors to build trust.

Visit your nearest Akhuwat branch for assistance in Urdu. You can also call or message support for help in Urdu.

In Sindh, find your closest Akhuwat regional office on the website or call the helpline to reach provincial staff.

Yes, you can update your application at the branch where you submitted it or by calling support with your CNIC and application number.

You can apply for a second loan only after paying back the first one. Each application is reviewed individually.

In some areas, Akhuwat provides mentoring, business planning help, and training, especially for women and youth.

Student loans are usually approved within 2 to 3 weeks after verifying documents and proof of admission.

Yes, Akhuwat loans follow Islamic finance principles (Qarz-e-Hasna) and are completely interest-free (Riba-free).

Yes, widows are encouraged to apply, especially for housing, education, or small home-based businesses.

Yes, Akhuwat supports e-commerce, freelancing, and digital business ideas under its startup loan category for youth and women.

You will be contacted by phone or SMS. You can also check your status online with your CNIC or form number.

Some loans have a 1-month grace period before repayments start. This varies based on the loan type and your financial situation.

Yes, Akhuwat welcomes applications from the transgender community for all types of interest-free loans.

Akhuwat has over 800 branches across Pakistan. You can find the nearest one on the website or by calling the helpline.

Borrowers in rural areas can repay through mobile wallets, community coordinators, or local Akhuwat offices, depending on what's available.

Akhuwat (Registration Number 3048949, NTN 3048949) is a non-profit organization which was registered in 2003 under Pakistan’s Societies Registration Act XXI of 1860. Akhuwat is an approved NGO by Pakistan’s Federal Board of Revenue. For documentation review please click here